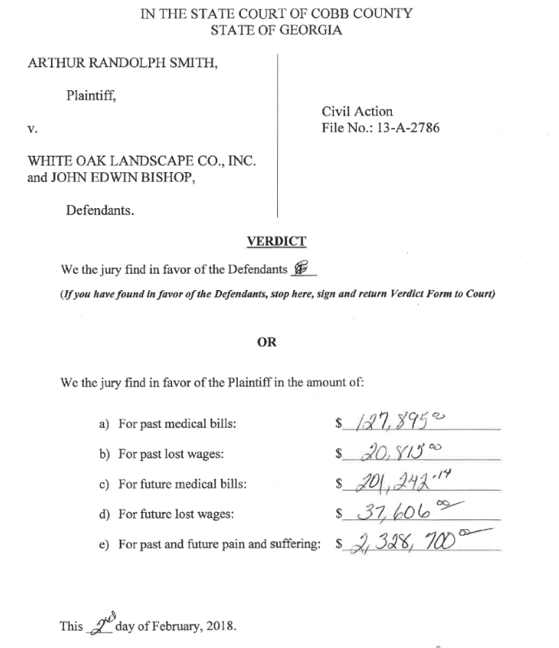

The story goes something like this, the plaintiff drives away after being rear-ended at a red light. The impact speed was estimated at 4 mph; however, later on…the plaintiff complains of neck stiffness and ultimately undergoes spinal fusion surgery. Given the circumstances of the accident, the defendant claims the neck surgery was unnecessary. The jury sided with the plaintiff, awarding $400,000 for medical bills and lost wages, plus $2,300,000 for pain and suffering (Smith vs. Bishop, 2/2/18)

The Relationship Between Social Inflation and Personal Liability Exposure

Stories such as these are likely more common than you think. According to Jury Verdict Research’s, Current Award Trends in Personal Injury, 54 th Edition (2015), the percentage of personal injury awards exceeding $1,000,000 has increased throughout the entire U.S., with the Midwest and Southeast seeing the greatest increases. Also, according to this same report, the median personal injury compensatory award in places like New York and Illinois are up to 5x greater than the nationwide median.

Considering the rise in plaintiff awards for personal injury claims far outpaces the increasing cost of medical services, what other factors are contributing to higher awarded damages? A Google search for ‘pain and suffering’ returns the following: “Injury Claim Coach, Increase your Pain and Suffering Award by Thinking Link a Claims Adjuster” ( www.injuryclaimcoach.com )

Many believe examples such as this Google search result illustrate an effort by a well-capitalized industry to influence these trends via a phenomenon known as Social Inflation.

SOCIAL INFLATION

Within the Property and Casualty insurance industry, many believe Social Inflation is the primary threat to the industry’s already marginal profitability. According to a June 2017 Assured Research report, evidence is mounting that social inflation has returned after a 20-year hiatus.

Although Social Inflation is not universally defined, most would agree that it contains changes in the propensity of the legal system to interpret contracts broadly or reward plaintiffs with rising levels of awards. Social inflation also encompasses the trend of claimants to involve an attorney in their claim – or to file a claim or lawsuit in the first place .

TRIAL LAW MARKETING: BROADCAST, SEARCH AND SOCIAL MEDIA STRATEGIES

Trial Attorneys are spending more than $900 million on television advertising each year – a 70% increase since 2008 and a rate of growth that far outpaces TV spending by all other industries. According to the Institute for Legal Reform, “Legal television ad spending, unlike other major TV advertising categories, such as automotive sales, restaurants, and product retailers, has consistently increased before and after the Great Recession (2008). Legal advertising is not only recession-proof, but also politics-proof, as it does not decrease during election years as it does for other advertisers due to higher spot costs and lower spot availability.”

In addition to traditional TV advertising, lawyers are also major players in social media and online marketing with 20% of law firms surveyed saying they have invested in content generation over the past two years. Specific to personal injury litigation, 23 of the top 25 Google key words are for personal injury law firms. “San Antonio car wreck attorney,” at the time of the ILR report, was the most expensive Google key word at $670 per click.

PERSONAL INJURY VERDICT TRENDS - ALL U.S. STATES

AWARDED DAMAGES

< $100,000

$100,000-$499,999

$500,000-$999,999

$1,000,000-$4,999,999

> $5,000,000

1995

65%

21%

6%

8%

< 1%

2015

62%

18%

5%

10%

5%

GROWTH (+/-)

-3%

-3%

-1%

2%

5%

FINDING SAFE HARBOR

Given high personal injury awards are decreasingly correlated with a defendant’s gross negligence, having a high-limit, personal liability umbrella insurance policy is an essential estate planning strategy. However, Ace Private Risk Services (now Chubb Insurance) surveyed individuals with a minimum net worth of $5 million and found that 20% of respondents did not have an umbrella policy and 25% purchased limits less than $5 million. It can only be assumed these individuals have been poorly advised and are unaware of the significant financial risk they retain.

Simply purchasing an umbrella policy is not enough. Policy limit selection is vitally important and must consider the following three factors:

- An insurance company’s motivation is to settle a claim for the least amount of money possible relative to the policy limit

- Personal injury jury verdict data

- Special individual circumstances (public profile, family dynamics)

Personal injury verdict and societal trends are not favorable to the defendant. Efficient risk transfer tactics are widely available but, as the data suggests above, too often overlooked. Personally indemnifying someone else’s pain and suffering is avoidable. It all begins with one phone call…to your insurance advisor.